Check out our FAQ about lending with local mortgage officer, Travis Bohrer!

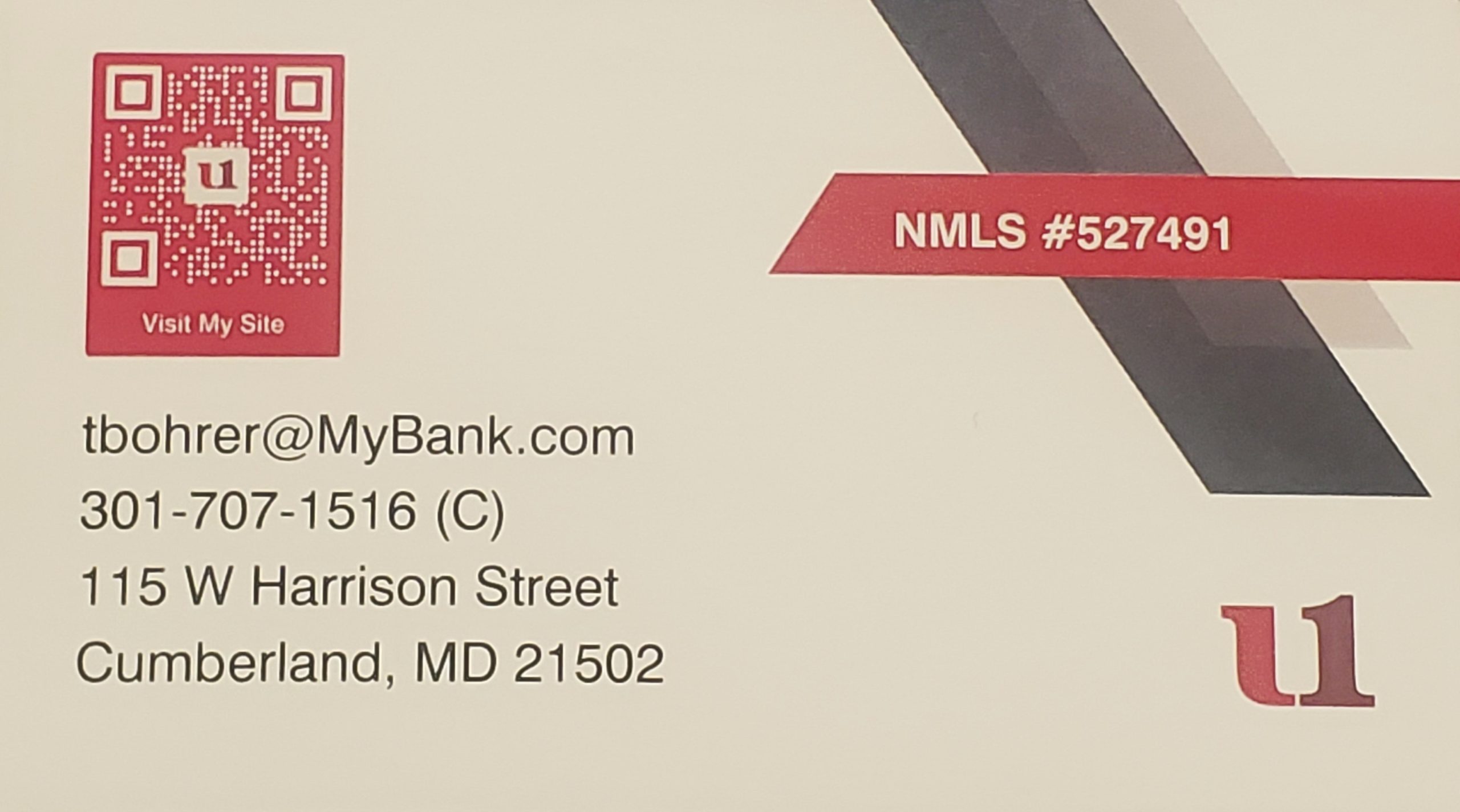

Your name: Travis Bohrer

Website: https://tbohrer-mybank.mortgagewebcenter.com/responsive/#/ApplyNow

Email: tbohrer@mybank.com

Phone Number: 301-707-1516 (voice & text)

Q: What makes First United stand out in comparison to other banks?

A: First United Bank has local originators, processors, underwriters and behind-the-scenes staff only a phone call away.

This means that not only will each borrower receive specialized attention but we understand that not every circumstance is “cookie cutter”.

Our flexible underwriting team and large portfolio of loan products allows us to work with many extraordinary circumstances.

We can offer loans for buy, build, renovation, investment, lots, and land.

We can work w extraordinary circumstances.

Q: What kind of properties do you specialize in?

A: We do not have a specialization in properties.

Large new builds, single-family purchases, multi family up to 4 units, manufactured homes and even 100 acre properties can all be done here at First United.

Q: What kinds of loans does First United offer?

A: The most familiar programs we offer include Conforming Fannie Mae/Conventional loans, FHA, VA, and USDA through our investor channels.

We also have our own in-house portfolio loans such as First Time Homebuyer, Professionals Programs, Second/Vacation Homes, Construction and Land loans.

Most of these in-house products can be paired with fixed or adjustable (ARM) rates.

Q: What are the current interest rates?

A: Rates are based on many factors such as loan program, credit score and loan size.

Government loan programs (USDA, FHA and VA) are very competitive right now.

We are seeing many gov loan borrowers score rates in the low 6’s and even a few in the high 5’s.

Q: Where does my credit score need to be in order to qualify for a loan?

A: Obviously the higher your score the better but ..Different programs allow different scores for approvals. Some FHA programs will allow credit scores in the upper 500’s to be approved. Some programs require scores above a minimum score of 620. Some programs have minimum credit scores of 700. It all depends on where we can get you approved. Please remember that in most cases your credit scores will directly affect the interest rate that you will pay.

Q: Do I have to put down a downpayment for a home?

A: Not necessarily … There are mortgage programs & grant programs that may be able to help w any required down payment.

Q: I am a first-time homebuyer. Does this get me any special perks?

A: Becoming a first-time homebuyer is a large step in your financial journey. We understand and appreciate that situation. Sometimes lenders will offer incentives to first-time homebuyers. There may special programs for first-time homebuyers that are not available to non-qualified buyers. For instance, if you are buying in the state of Maryland you will receive real estate transfer tax exemptions as a first-time homebuyer.

Q: I have no money for a downpayment or closing cost assistance. Is it a possibility I could still be approved for a mortgage?

A: Absolutely! We offer a USDA loan which requires zero down payment. Other options include down payment assistance programs, and/or seller concessions. Every buyer and transaction may not meet these qualifications so ideally we always recommend having “reserves” (back up funds) available just in case funds should be needed to close.

Q: I am a veteran. Do you do VA loans?

A: We do … VA loans are a great tool for those of us that can take advantage of their benefits which include 100% financing, reduced closing costs, and no monthly mortgage insurance.

Q: I want to buy a fixer-upper. Do you have a loan product that would allow me to purchase this property without having to do repairs prior to closing?

A: We do …This would be a situation where we would use our construction renovation program. This allows you to purchase the home and have a plan and the money in place to have the renovations completed.

Q: Land and commercial loans are hard to find! Do you offer these products?

A: We do … Land loans are hard to find but we can accommodate those requests using our in-house loan programs. Down payment requirements and terms are different for these programs.

Q: Once I get a home under contract, what are the next steps in terms of my financing?

A: Once your home is under contract you will need to have all your documentation in place so that I may be able to get you approved for your mortgage loan. Once that approval is given it will also be time to schedule your appraisal, any inspections and the title work for your new home or property.

Q: How long does it typically take to buy a home once I get it under contract?

A: Typically most mortgages can be done in about 30 days from complete application to closing.

We manage a lot of moving parts to get each loan to closing.

Q: How much are closing costs and what do my closing costs consist of?

A: Closing costs are the monies you will need that it will take to get a mortgage loan closed & transfer the sale of a property ownership over you. They consist of this such as bank fees, points, appraisal, inspections, attorney fees, real estate taxes, recordation transfer taxes and escrow setup.

Q: Anything else you want to add?

A: First United Bank is now a one-stop shop for mortgage programs.

We have a great local team. We offer more program options than any other local lender. We have the ability to select the appropriate mortgage program for each and every borrower based on their own personal situation.

Whether your buyers are looking for an initial prequalification to get a working budget for a home purchase or you are buying your forever dream home we can help get them in the best mortgage program available.

Get mortgage information or Apply Now (Travis Bohrer – First United Bank)